Down Payment Help

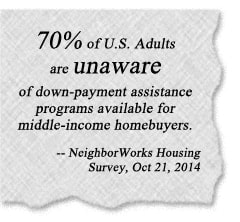

Many individuals aren’t aware that there are options out there to help with cash to close, interest rates, mortgage insurance, and other aspects of the loan.

IF your rent is $1665 a month you are giving away $20,000.00 a year to your landlord

Simple Math (1665.00 x 12 months = 20k)

How long have you been renting (5 years -100k )(7 years -140k) (10 years_ when does this $top)

Get off the landlord treadmill...You have happily paid your rent on time for the last 5 years and your landlord has thanked you by Raising YOUR RENT!

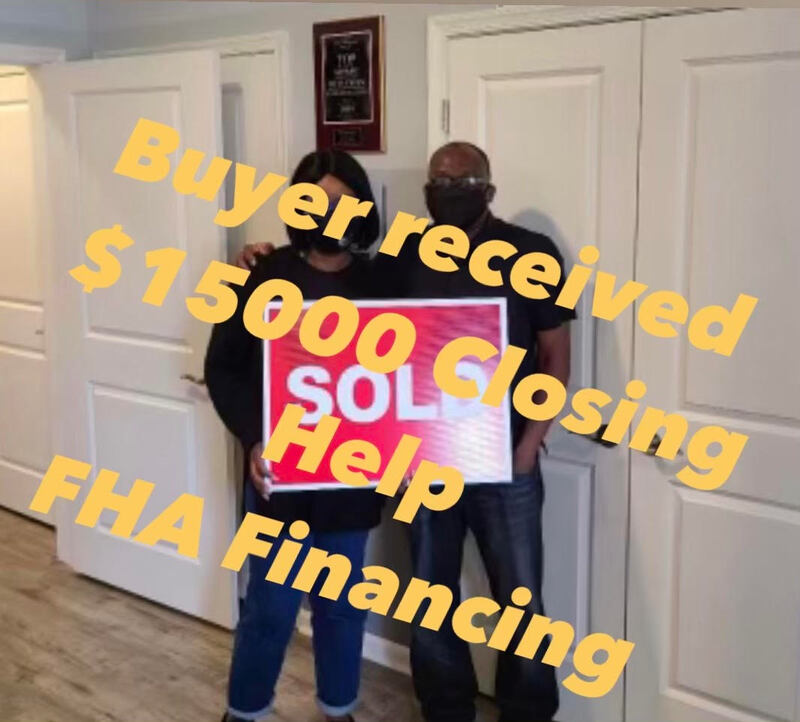

These 1st time homebuyers got rid of their landlords and received plenty of closing help. They now have their own backyard and don’t have to be worried about Rent raises or noisy neighbors. They have their own personal parking spaces and can decorate their home any way they like!

With my help as their realtor we were able to get them a home with little money out of their pocket! These are ordinary people that overcame obstacles to make their purchase! One client had to make payments on time for 11 months before purchasing; one person had a landlord that did minimal repairs making the rental they lived in unhealthy. All of their credit scores were below 700! They all purchased with FHA loans! They have said Bye-Bye to their landlord! They are now paying off their own home and building wealth!

The program I am using is very popular it helps buyers with 3.5% - 5% of the down payment. It covers the ENTIRE 3.5% down payment for the buyer in the form of a loan or forgivable grant and it is available nationwide. All loans are 30-year fixed.

I was speaking with a client the other day, a single parent, with a school age child. (The client was a long term tenant; the landlord is cashing in their equity in their home and asked them to move out in 30 days)

I asked are you interested in buying instead of renting. They responded, I don't make enough money to buy the home I want right now. I explained if you purchased a home now over the next 5 years you would be putting $100k in to YOUR home instead of your landlord’s pocket. You could use that $100k in five years to buy a bigger home or fund your child's education.

Simply changing your rental payments to mortgage payments will save you $100k over the next 5 years. Will you make the change; I am not counting the tax deductions or the rise in property value in the 100k.

IF your rent is $1665 a month you are giving away $20,000.00 a year to your landlord

Simple Math (1665.00 x 12 months = 20k)

How long have you been renting (5 years -100k )(7 years -140k) (10 years_ when does this $top)

Get off the landlord treadmill...You have happily paid your rent on time for the last 5 years and your landlord has thanked you by Raising YOUR RENT!

These 1st time homebuyers got rid of their landlords and received plenty of closing help. They now have their own backyard and don’t have to be worried about Rent raises or noisy neighbors. They have their own personal parking spaces and can decorate their home any way they like!

With my help as their realtor we were able to get them a home with little money out of their pocket! These are ordinary people that overcame obstacles to make their purchase! One client had to make payments on time for 11 months before purchasing; one person had a landlord that did minimal repairs making the rental they lived in unhealthy. All of their credit scores were below 700! They all purchased with FHA loans! They have said Bye-Bye to their landlord! They are now paying off their own home and building wealth!

The program I am using is very popular it helps buyers with 3.5% - 5% of the down payment. It covers the ENTIRE 3.5% down payment for the buyer in the form of a loan or forgivable grant and it is available nationwide. All loans are 30-year fixed.

I was speaking with a client the other day, a single parent, with a school age child. (The client was a long term tenant; the landlord is cashing in their equity in their home and asked them to move out in 30 days)

I asked are you interested in buying instead of renting. They responded, I don't make enough money to buy the home I want right now. I explained if you purchased a home now over the next 5 years you would be putting $100k in to YOUR home instead of your landlord’s pocket. You could use that $100k in five years to buy a bigger home or fund your child's education.

Simply changing your rental payments to mortgage payments will save you $100k over the next 5 years. Will you make the change; I am not counting the tax deductions or the rise in property value in the 100k.

What’s stopping you from buying a home? The costs of down payment and settlement can overwhelm first-time home buyers and is listed as the number one barrier to home ownership. If you've been thinking of buying a home, this will be music to your ears!

This program covers your down payment. Purchase a home with a Minimum Credit scores 620. A $300,000 home has a mortgage less than $1665 a month.

This program is the most popular helping buyers with 3.5% of the down payment. It covers the ENTIRE 3.5% down payment for the buyer in the form of a loan or forgivable grant and it is available nationwide. All loans are 30-year fixed

Contact me today

http://www.1sthousenetwork.com/down-payment-grant.html

You could be in your new home in the next 60 days!

If you are paying more than $1665 a month for rent, there is no doubt that you can own your own home. Many renters just don’t realize how easy it is to own a home of their own. They just continue making payments on their landlord’s mortgage feeling more frustrated every month.

If you are paying more than $1665 a month for rent, there are several lovely homes that you could own with monthly payments as affordable as your rent.

My claims may sound outrageous but I urge you to visit Bankrate.com and enter the numbers in the mortgage calculator and see the results for yourself. Example $300k Home with a 4% interest rate = a payment of $1665.00. You can find out more by contacting me.

Contact me today

http://www.1sthousenetwork.com/down-payment-grant.html

I work with one of the best lenders in the state; they make sure that you get the lowest possible rate and down payment help. The best part is that you could be in your new home in 60 days! Getting pre-qualified is easier than completing a rental application and the process can be done by phone, free of charge!

You can buy a home with a down payment that is less than you would pay for 1st month’s rent and security deposit for a rental. Remember, most of these homes will have monthly payments similar or less than what you're already paying in rent so you will transition from tenant to owner seamlessly.

I know what you’re thinking: “My landlord looks so happy when I help pay his building/home off every month”, “I love paying pet fees, security deposits, and late fees to my landlord” “I love the four white walls that I cannot paint, fighting for parking spaces and listening to the neighbors argue every night” - but you don’t have to because you are only a call away from a quiet treed lined street with more space for the family and hosting holiday parties at your house where you make all the rules.

Many renters just don’t realize how easy it is to own a home of their own. They just continue making payments on their landlord’s mortgage feeling more frustrated every month.

Coming up with a down payment for your first home can be a major roadblock and quite often the reason for renting, rather than owning a home.

Example: Buyer receives 5% grant

Sale Price $250000

You receive Down payment grant $12,500...covers your 3.5 down payment and 1.5% of your closing

Seller gives you 3-6% closing help…$7500-$15000

In this example you receive $20,000-$27,500 to purchase your home. My clients have received plenty of closing help!

Contact me today

http://www.1sthousenetwork.com/first-time-home-buyer-down-payment-assistance.html

Credit score below 620? Lender will discuss options to raise your score in the next 30 days, I also offer Free credit repair (at no charge) if you need to raise your score.

If this message triggers your interest, feel free to request additional information.

Contact me today

http://www.1sthousenetwork.com/down-payment-grant.html

This program covers your down payment. Purchase a home with a Minimum Credit scores 620. A $300,000 home has a mortgage less than $1665 a month.

This program is the most popular helping buyers with 3.5% of the down payment. It covers the ENTIRE 3.5% down payment for the buyer in the form of a loan or forgivable grant and it is available nationwide. All loans are 30-year fixed

Contact me today

http://www.1sthousenetwork.com/down-payment-grant.html

You could be in your new home in the next 60 days!

If you are paying more than $1665 a month for rent, there is no doubt that you can own your own home. Many renters just don’t realize how easy it is to own a home of their own. They just continue making payments on their landlord’s mortgage feeling more frustrated every month.

If you are paying more than $1665 a month for rent, there are several lovely homes that you could own with monthly payments as affordable as your rent.

My claims may sound outrageous but I urge you to visit Bankrate.com and enter the numbers in the mortgage calculator and see the results for yourself. Example $300k Home with a 4% interest rate = a payment of $1665.00. You can find out more by contacting me.

Contact me today

http://www.1sthousenetwork.com/down-payment-grant.html

I work with one of the best lenders in the state; they make sure that you get the lowest possible rate and down payment help. The best part is that you could be in your new home in 60 days! Getting pre-qualified is easier than completing a rental application and the process can be done by phone, free of charge!

You can buy a home with a down payment that is less than you would pay for 1st month’s rent and security deposit for a rental. Remember, most of these homes will have monthly payments similar or less than what you're already paying in rent so you will transition from tenant to owner seamlessly.

I know what you’re thinking: “My landlord looks so happy when I help pay his building/home off every month”, “I love paying pet fees, security deposits, and late fees to my landlord” “I love the four white walls that I cannot paint, fighting for parking spaces and listening to the neighbors argue every night” - but you don’t have to because you are only a call away from a quiet treed lined street with more space for the family and hosting holiday parties at your house where you make all the rules.

Many renters just don’t realize how easy it is to own a home of their own. They just continue making payments on their landlord’s mortgage feeling more frustrated every month.

Coming up with a down payment for your first home can be a major roadblock and quite often the reason for renting, rather than owning a home.

Example: Buyer receives 5% grant

Sale Price $250000

You receive Down payment grant $12,500...covers your 3.5 down payment and 1.5% of your closing

Seller gives you 3-6% closing help…$7500-$15000

In this example you receive $20,000-$27,500 to purchase your home. My clients have received plenty of closing help!

Contact me today

http://www.1sthousenetwork.com/first-time-home-buyer-down-payment-assistance.html

Credit score below 620? Lender will discuss options to raise your score in the next 30 days, I also offer Free credit repair (at no charge) if you need to raise your score.

If this message triggers your interest, feel free to request additional information.

Contact me today

http://www.1sthousenetwork.com/down-payment-grant.html