My Clients received over $250,000.00 in

Down payment assistance and Closing Help

Last Year!

Need money to purchase your First Home, receive $5000 - $84000. Contact me for details.

Home buyers can receive down payment and closing costs assistance.

Contact me today to Use of one these 20 down payment programs to purchase your Home

If you have $500 you can receive $84,000 in Down payment assistance when you purchase in Washington, DC.

DCHFA’s DC Open Doors program is built around a Down Payment Assistance Loan (DPAL) that does not have to be paid back. This is essentially “free money” – the Down Payment Loan’s balance due reduces by 20% each year for a term of 5 years, ending in a zero balance due. DC Open Doors is a true zero down program for Washington, D.C. that cuts your out-of-pocket costs on a home or condo purchase to just closing costs and other processing fees.

The Employer Assisted Housing Program is known as EAHP.

EAHP provides city workers with help to cover the down payment and closing costs associated with a home purchase in the city. Up to $25,000 in assistance is available for most workers. First-responders can receive an additional $20,000 in benefits. For all District workers, funds are provided in the form of a deferred loan with a maximum amount of $20,000. This is a zero-interest, deferred loan and no payments are required until the home is sold.

The matching funds grant provides $1,000 in grant funds to match each $2,500 in borrower funds, up to $5,000 in grant funds.

First-responders can get the benefits listed above, plus more. You can receive a $10,000 recoverable grant if you complete a five-year service agreement. Your matching funds grant grows in $1,500 increments for each $2,500 in borrower funds, up to $15,000 in grant funds.

EAHP provides city workers with help to cover the down payment and closing costs associated with a home purchase in the city. Up to $25,000 in assistance is available for most workers. First-responders can receive an additional $20,000 in benefits. For all District workers, funds are provided in the form of a deferred loan with a maximum amount of $20,000. This is a zero-interest, deferred loan and no payments are required until the home is sold.

The matching funds grant provides $1,000 in grant funds to match each $2,500 in borrower funds, up to $5,000 in grant funds.

First-responders can get the benefits listed above, plus more. You can receive a $10,000 recoverable grant if you complete a five-year service agreement. Your matching funds grant grows in $1,500 increments for each $2,500 in borrower funds, up to $15,000 in grant funds.

A USDA home loan is a zero down payment mortgage for eligible rural and suburban homebuyers. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, by the United States Department of Agriculture.

Chenoa Fund is an affordable housing program funded by CBCMA, a federally chartered government agency. CBCMA's mission is to increase affordable and sustainable home ownership, specifically for credit-worthy, low- and moderate-income individuals. CBCMA specializes in providing financing for loans under the guidelines of FHA and Fannie Mae and partners with quality mortgage lenders on a correspondent basis.With this program, borrowers receive a 30-year term, 0% rate, no payment second mortgage.The loan is forgiven once the borrower makes 36 consecutive on-time payments on the original FHA first mortgage.

Prince George's County Purchase Assistance Program (PGCPAP) The PGCPAP remaining available balance is $1,525,399.10 as of January 1, 2019. Loan Terms Maximum loan: $15,000.00 Loan terms: 0% interest, deferred payment. If the buyer is one of the following, Police Officer, Deputy Sheriff, Classroom Teacher, Firefighter, Emergency Medical Technician , Nurse, they may be eligible for an additional $5,000 based on their need. This would bring the total loan amount to $20,000. Purchaser must pay back the loan in full when the home is sold, transferred or ceases to be the primary residence of the buyer(s) regardless of the length of residency.

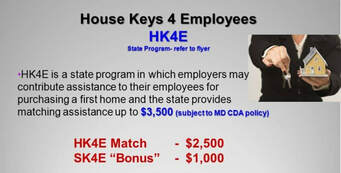

As a participating employer, the State provides financial assistance to active State of Maryland government employees (permanent and contractual employees) purchasing a home through the Maryland Mortgage Program. The amount available to State employees through the House Keys 4 Employees Program is in addition to the Down Payment Assistance available to Maryland Mortgage Program borrowers. State of Maryland employees that are eligible for the Maryland Mortgage Program can receive an additional $2,500 in Down Payment Assistance, in the form of an interest-free, deferred loan through the House Keys 4 Employees program. A further $1,000 in Down Payment Assistance through the Smart Keys 4

First Time Home buyer Assistance Program. If you are a first-time home buyer, you could be eligible for up to $10,000 in down payment and closing cost toward the purchase of your first home. ... Pathway to Purchase is a 0% interest, deferred payment loan

BALTIMORE

Baltimore City Employer Home ownership Program - $5000

Baltimore City Live near Your Work - $5000

Vacants to Value Baltimore City - $10000

Block Grant Baltimore City - $5000

Buying into Baltimore City - $5000

Baltimore County - $20000

Baltimore County SELP -$10000

Baltimore City Live near Your Work - $5000

Vacants to Value Baltimore City - $10000

Block Grant Baltimore City - $5000

Buying into Baltimore City - $5000

Baltimore County - $20000

Baltimore County SELP -$10000

The Montgomery Homeownership Program II, an initiative of the Maryland Mortgage Program in partnership with Montgomery County, gives eligible home buyers purchasing in Montgomery County up to $25,000 in down payment assistance.

Maryland SmartBuy helps homebuyers with qualifying student debt purchase a home. The program works by paying off student debt during the purchase of the home through special Maryland Mortgage Program (MMP) financing.

State of Maryland Grant Assist - 4% Grant

State of Maryand 1st Time Advantage - 3% Grant

State of Maryland DSELP - $5000

Homeowner's Property Tax Credit

State of Maryand 1st Time Advantage - 3% Grant

State of Maryland DSELP - $5000

Homeowner's Property Tax Credit